Car parks: future-proof or soon to be passé?

Parking properties offer long-term rental income and generally outperform office or retail at comparable locations. And, the future for car parks remains bright.

Car park properties are a firmly established real estate investment class, offering stable long-term rental income and generally outperform office or retail investments at comparable locations. But what does their future look like in an emerging era of urban and ‘multi-modal’ consumers, relying on and alternating between bicycles, public transport, car-sharing and the self-driving electric car? Will car parks still be a profitable investment segment in 10-15 years from now?

Bouwfonds IM believes so, based on the insights and considerations that are emerging from its operations and discussions with industry experts.

PASSENGER CAR GROWTH

Fundamental factors that drive car park attractiveness, such as new car registrations, and the total number of passenger cars, are expected to maintain their positive growth trajectory. We are still seeing continued growth in car registrations in our core markets in Western Europe: Belgium, Germany, France, the UK, the Netherlands and Spain. This is mainly caused by Europe’s steady growth in the number of households – notably in major urban centres and in spite of slowing or stagnating overall population growth in a few countries. While passenger car registrations are expected to peak by 2020 in some countries, such as Belgium, continued growth is expected in others – in Germany, for example, until 2025. We believe that this trend provides a sound basis for car park investments.

Total registrations are set to tail off slightly after 2025, but the decrease is likely to be very small and in our view no cause for concern. Even though registrations of new passenger cars are expected to tail off after 2025, the total number of passenger cars on European roads is expected to continue to rise for some time. In fact, the International Council on Clean Transportation Europe expects the total number of cars on European roads to increase from 251 million in 2015 to 258 million in 2030. Beyond that, even in 2040, the number of cars on the road in Germany for example is likely to be only 1.5 percent (or 600,000 vehicles) below the present total. This small decrease is mainly caused by a declining German population. In other major European economies it is expected that the number of cars in 2040 will be above the current total, due to increases in population and the number of households.

TECHNOLOGICAL DEVELOPMENT

We feel that the forecasts for the total number of cars on Europe’s roads are credible, even in light of technological advancements, such as car-sharing and autonomous driving.

It is frequently suggested in the market that autonomous driven shared cars will make car parks in innercity locations obsolete. We at Bouwfonds IM are sceptical about these forecasts and do not believe that these technological developments will become so popular in the foreseeable future that Europe’s total “fleet” of cars would start shrinking as a result – thereby reducing demand for parking space.

Admittedly, there has been marked growth in recent years in the number of people who have signed up to car-sharing platforms such as Car2go and DriveNow, notably in the major German cities. But we think the long-term effect of car-sharing is overestimated, as the number of shared cars only account for a small proportions of the total number of vehicles. Take Germany again, for example. In 2016, it had just 17,200 car-sharing vehicles: 9,400 in station-based car-sharing, and 7,800 in free-floating car-sharing. That is less than half a percent of the country’s total ‘fleet’ of around 40 million passenger cars. As for autonomous driving, the consulting firm McKinsey has noted in a recent study (Automotive Revolution – Perspective Towards 2030) that it is expected to catch up only slowly due to the significant technological and regulatory challenges involved. McKinsey forecasts that by 2030, some 15 percent of all cars could be fully self-driving, and around 50 percent largely self-driven.

AUTONOMOUS CARS

Technical and regulatory challenges aside, we see multiple other reasons, which explain why the growth in car-sharing and autonomous cars will not rise steeper in the near future. Available evidence suggests that most people strongly prefer ready and exclusive access to a car of their own. In addition, while densely populated urban centres tend to provide suitable public transport alternatives, this is typically less so in the suburbs and the countryside beyond.

As with conventional public transport, car-sharing (with or without a human driver) is unlikely to work very well in the countryside, where potential users will be fewer and further between. Many people who live in the suburbs and beyond and who currently own a car are therefore likely

to hold on to it. We also fail to see how car-sharing, in whatever shape or form, could meet the sharp fluctuations in transportation needs into and out of city centres on a massive scale over the course of an average working day. Truly autonomous driving could actually increase the number of potential car users. A shift from personally owned driver-driven to shared autonomous vehicles could significantly lower the cost of mobility per kilometre, according to McKinsey. This in turn could make driving more attractive and even more common, as autonomous cars could address new target groups such as very elderly people, children, and disabled people, which cannot drive themselves, to take to the road. Other technological developments could also boost the utilization of off-street car parks. Car park utilization strongly depends on the location, more specifically the proximity to frequently visited destinations such as the city centre, airport or hospital. But a car park’s integration in local parking guidance systems is also very important. Urban parking guidance systems are constantly being improved. Signs posted along entry routes into cities show drivers in real-time how many parking spaces are available at specific car parks. This minimizes the number of cars driving around merely to find a place to park.

OFF-STREET CAR PARKS

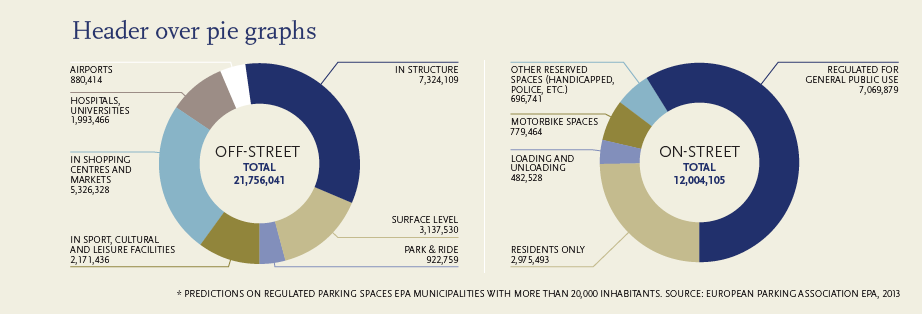

The outlook for off-street car parks – which account for about one-fifth of the estimated 34 million parking spaces across Europe – are buffeted by a trend against on-street parking in many city and town centres. In today’s digitalizing, war-for-talent economies, cities are growing fast, and municipal authorities are actively trying to make their town and city centres multi-functional and more attractive. The Norwegian capital Oslo, for example, eliminated a thousand on-street parking spaces in the city centre last June, forcing people to park their vehicles in the car parks surrounding this car-free zone.

The same dynamics that cause municipalities to reduce on-street parking spots, will also create new opportunities for owners to upgrade their parking properties by adding more functions. Car parks are increasingly becoming mobility hubs and service centres, featuring bicycle-hire points, charging stations, cleaning services and supermarkets. All this provides new sources of revenue for investors.

Off-street car parks are the answer to increasing mobility and restrained on-street parking supply. Due to growth in the number of European households, the number of cars will continue to rise, despite trends such as car sharing and autonomous driving. This, together with growing demand, will result in further increases in tariffs and revenue growth over and above inflation. There is no vacancy to speak of in the sector, and the long-term risk-return profile looks strong for city locations that serve as ‘gateways’ to a wide range of destinations and functions.

WWW.PROPERTYEU.INFO | OCTOBER 2017

- Like

- Opslaan